The Counterpoint is a free newsletter that uses both analytic and holistic thinking to examine the wider world. My goal is that you find it ‘worth reading’ rather than it necessarily ‘being right.’ Expect semi-regular updates and essays on a variety of topics. I genuinely appreciate any and all sharing or subscriptions, as it helps support the newsletter, my family, and farm.

You might’ve heard that the United States is inaugurating a new president today. All new presidential administrations have an element of a “turning point in history” to them, but this one certainly feels like it. With the Republican party emboldened like it hasn’t been in decades and the opposition Democrats feeling a surreal mix of resignation and shifting tides, it seems like the new administration, backed by a favorable Congress and Supreme Court, will have the chance to shape America as it sees fit.

What better time to play a game of predictions?

Below are seventeen predictions (plus an emergency eighteenth) for the next four years. I’ve tried to make them both specific and interesting (no “Trump passes at least three pieces of unspecified legislation that are deemed major” or “Trump tweets 10,000 times”). I’ve also assigned probabilities to every prediction so that you have a better sense of my confidence in each.

Finally, to be upfront about my bias, I’ve been quite public that I think Donald Trump was the worst president in American history. But I’ve also written about how he was the best president to have in office during the pandemic. So while you will probably pick up that I don’t think the second Trump administration will go well, I hope that you recognize that I’m a “straight shooter” that has thought about each of these and am making honest predictions, with my reasoning explained for each.

As I say in the preamble, my goal is that you find this newsletter is ‘worth reading’ rather than it necessarily ‘being right.’ But to be clear, I am trying to be right here, and we’ll review at both the midterms and the end of the presidential term.

In the 2026 midterms, Democrats will gain 25 Congressional seats (80%)

The thesis of my “The Election Wasn’t a Red Wave” was that Donald Trump was a uniquely-likeable, outsider candidate running against an unpopular incumbent during the largest wave of anti-incumbency in global history, yet despite this, only just barely won both the electoral college and the popular vote.

This thesis has a very easy conclusion that follows from it: without Donald Trump himself on the ballot drawing the low-propensity voters who love him and with Democrats no longer being the incumbents but now being boosted by midterm thermostatic backlash, there will be a “Blue Wave” in the 2026 midterms.

In the 2018 midterms during Trump’s first term, Democrats won a total of 235 seats. This was a gain of 41 seats, but they started from a much lower number. Democrats currently hold 215 seats, so a gain of +25 would put them at 240 seats, five more than the quite historic “Blue Wave” of 2018.

Raw milk will be ‘legalized’ (40%)

Raw milk is an increasingly popular health trend, so much so that it has been incorporated into the “Make American Healthy Again” (MAHA) movement, championed by RFK Jr. and various others.

Now, I put ‘legalized’ in quotes because I don’t believe it will be fully legalized; I don’t think “Big Dairy” would let Congress do that. But I do think eliminating some federal regulations and enforcement on raw milk producers will be an easy and high-profile “win” for the administration/RFK Jr. It would earn points with raw milk drinkers, while everyone else mostly won’t care (or at least forget about it in a few weeks).

Most of my uncertainty here is that I am simply not an legal expert on milk production and distribution rules, how much of it is federal vs state, how much “Big Dairy” will push back, and that RFK Jr. is the nominee for HHS, not USDA.

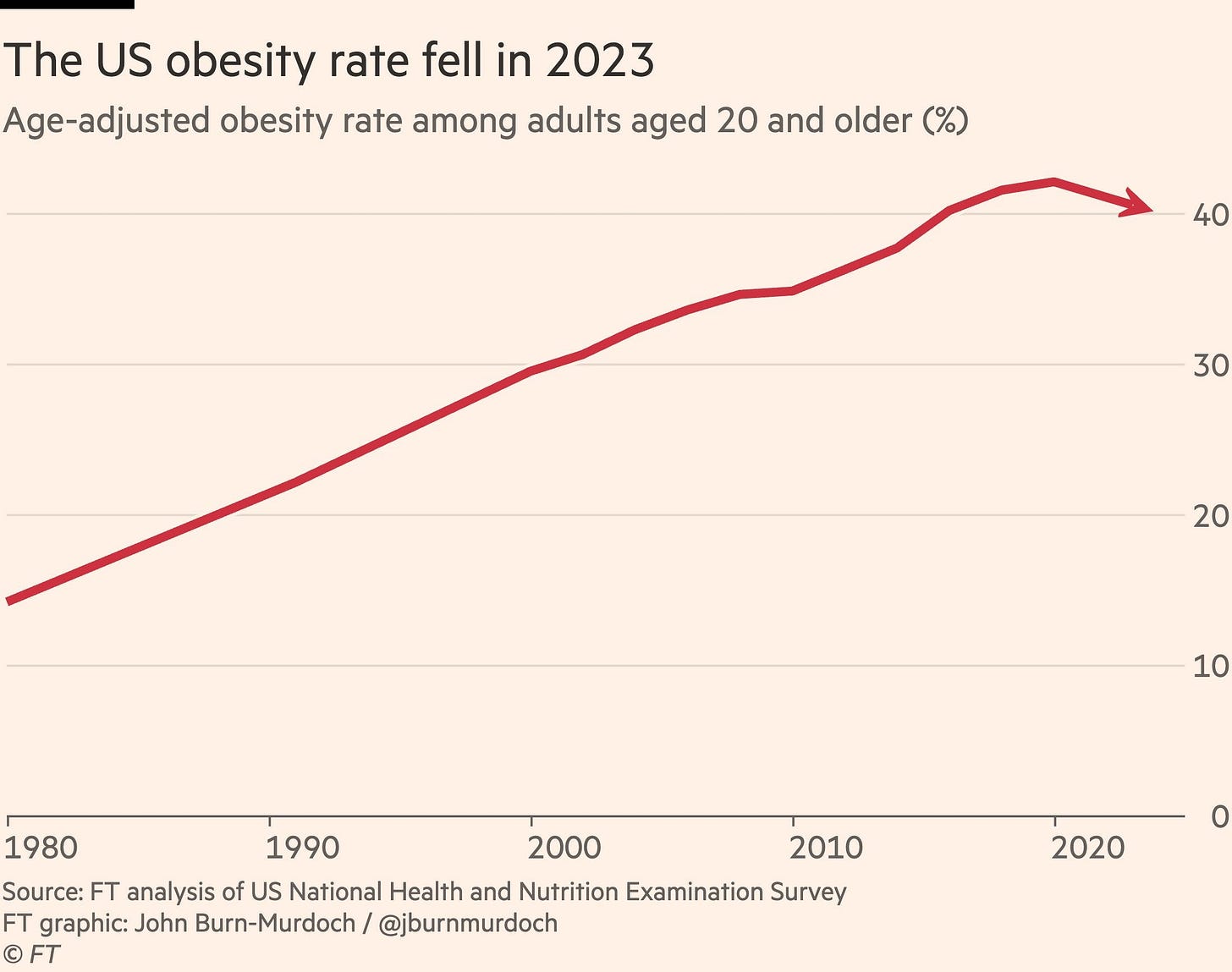

The obesity rate will continue to decline, with MAHA taking credit (70%)

In 2023, the American obesity rate broke it’s long-term trend and declined.

It is likely that this trend continue and very likely that the Trump administration and “MAHA” will take credit for it.

The decline in the obesity rate was almost certainly caused by the GLP-1 receptor agonists: semaglutide (made by Novo Nordisk, marketed as Ozempic and Wegovy) and tirzepatide (made by Eli Lilly, marketed as Mounjaro and Zepbound). The popularity of these drugs will continue causing the obesity rate to decline further.

The continuation of this trend is undoubtedly good, and I hope it continues. But the point I’m trying to make is that the reversal started in 2023 and will likely continue along its current trajectory. The GLP-1 pharmaceuticals are the reason for the decline and “MAHA” will not be the dominant factor in its continuation, yet the Trump administration will take credit for it.

If there is an oil price shock (in either direction), Trump will utilize the SPR (70%)

It is under-appreciated that President Biden pulled off the one of the greatest financial oil trades in history. Amid rapidly rising energy prices in 2022, the Biden administration released millions of barrels of oil from the United States’ Strategic Petroleum Reserve (SPR). Not only did this flood of supply break the price increases, but it shocked the system so much that prices have never recovered, even as the administration has begun refilling it, recording billions of dollars of profit.

Now, you can be mad that the Biden administration did this, but it did in fact work. We sold high, bought low. And perhaps manipulating the price of energy wasn’t the original purpose of the SPR, but very thoughtful arguments have been made that the SPR should be used to stabilize oil prices (think how the Federal Reserve manipulated interest rates up and down to help stabilize financial markets).

Now, whether or not it is right or wrong to use the SPR this way, the fact is that this particular can of worms has been opened, a precedent has been set. I believe that the Trump administration will do the same: if the price of oil spikes higher, the administration will begin releasing oil from the SPR; if the price of oil collapses lower, the administration will make huge purchase commitments.

I am actually so confident that they will do this, that most of my uncertainty lies with the “if there is an oil price shock” part of the prediction. It is possible that energy prices stay mostly steady for the next four years.

The United States will acquire Greenland (5%)

Trump has flirted with the idea of buying Greenland for years. And to be honest, I think it is a good idea, not so much for it’s hard-to-access mineral deposits as usually claimed, but it’s geostrategic position in the Artic Circle (below).

The United States is wealthy enough that we certainly could make Denmark an “offer they couldn’t refuse,” especially since Denmark has to subsidize Greenland upwards of ~$1B per year. But the more expensive the purchase, the more it would conflict with the Trump administration’s deficit and debt reduction goals, as well as be harder to pass through Congress. It also doesn’t help that Trump hasn’t exactly ingratiated himself with our European allies, and is taking more of the mocking bully approach to the situation.

It would be an interesting and mutually-beneficial acquisition, but I think it is very unlikely to happen.

The Tax Cuts and Jobs Act of 2017 will be renewed (80%)

The Tax Cuts and Jobs Act, colloquially known as the “Trump tax cuts,” was the most prominent piece of legislation from the first Trump administration. What most people might not know is that many of its provisions were made temporary to keep costs down and comply with the Byrd Rule (which prohibits reconciliation bills from raising the federal deficit beyond a 10-year budget window (or from making changes to Social Security)). Because of this, many of its provisions will expire at the end of 2025 and the following years.

The broader GOP doesn’t want to increase taxes, and neither does Trump himself, especially given that this was his signature piece of legislation. Both are heavily incentivized to extend most of the key features of this law.

It is unlikely that all the provisions will be extended, and I don’t know any special insight into which parts of the law will be renewed or modified, but I think it is extremely likely that some version of a “major tax cut” (but remember it is actually just an extension) will be signed into law.

The Federal Budget deficit will remain >3% of GDP (98%)

Scott Bessent, Trump’s nominee for Treasury Secretary, wants to achieve what he calls the “3-3-3” plan: reducing the federal budget deficit to 3% of GDP, averaging real GDP growth of 3% per year, and producing an additional 3 million barrels of oil a day by 2028.

I believe it is essentially impossible that the Trump administration will reduce the deficit to below 3% of GDP.

The deficit can only be decreased in three ways: raise revenue and/or cut spending and/or increase efficiency. The administration doesn’t want to raise taxes (see above section), leaving only spending cuts and increasing efficiency. The problem is that neither of them is large enough achieve the deficit reduction goal.

To handle the latter first, there simply isn’t multiple percentage points of GDP “efficiency” to be had. Contrary to popular belief, the relative size of the federal workforce has actually declined over time. And even if you wanted to close departments and layoff staff, then automatic stabilizers like unemployment would kick in, blunting the financial impacts.

The only real way to achieve large deficit reduction is through spending cuts. The problem is that the vast majority of federal outlays are either mandatory spending and net interest (below). And that mandatory spending will likely increase as the tail end of Boomers age into Social Security and the entire generation increases its utilization of Medicare.

Because meaningful spending reductions essentially requires some type of grand bargain with Social Security and/or Medicare, I have zero confidence (or I guess 2% confidence) that the Trump administration will be able to do that.

Our deficit will stay at >3% of GDP for the next four years.

American oil production will remain at current levels (90%)

Beyond Scott Bessent, pretty much everyone in the Trump administration claims that they will increase American energy production. I am extremely skeptical that this will happen. America is already at all-time highs in domestic oil production (below) and it will take costly and long-term investment (or a technological leap) to get large amounts of the next marginal barrels out of the ground. I don’t think this will happen in four years.

According to the EIA, the United States averaged 13,457 thousand barrels per day in October 2024, the last available data point at the time of writing. Giving myself 5% wiggle room, I don’t think the Trump administration will not hit a month of 14,130 thousand barrels per day during its tenure.

There will be a recession, as measured by NBER (70%)

Every single Republican president during my lifetime has caused a recession.

Okay, that’s a bit snarky, even if it is true. But in all seriousness, since World War 2, the economy has performed significantly better under Democrats than Republicans. The reasons for this are debated but the numbers are the numbers.

I’ve been a vocal economic bull since 2020’s economic stimulus (and I’ve taken much flak over it) and today, I remain bullish on the economic, though I do acknowledge some amount of softening that has occurred recently.

Being mostly an economic bull, I don’t have a short, catchy “bear case” for you beyond a gut feeling that is mostly the combination of two things that I think we can all agree on: we haven’t had a true economic cycle since 2008’s GFC (the brief economic recession of 2020 was self-induced) and that not only is Donald Trump quite volatile as a person (and the economy does not like volatile), but many of his policies (tariffs, immigration crackdowns, etc.) are outright bearish for short-term economic outlook even if they might be overall beneficial for other reasons.

Maybe the shorter version: there are reasons to believe that the economy is doing well but currently stumbling, we haven’t had a true recession in nearly two decades, and Trump is a bull in a china shop. If I had to bet, is more apt to mess things up, rather than steer us back on course.

Finally, a recession is not two quarters of negative GDP growth. Recessions are determined by the NBER, which uses a holistic approach (including GDP growth) to determine their start and end dates. This is why there was no recession in 2022, despite two quarters of negative GDP growth.

Turnover in the second Trump administration will remain extremely high (80%)

The first Trump administration had the highest rate of turnover in modern American history. I don’t think that will change. Perhaps it will come down some, given that he seems to be nominating “loyalists” but I expect to remain above every president since Carter.

The Trump administration won’t take on “Big Agriculture” (90%)

Regular readers know that in my spare time I own and operate a permaculture farm. For reasons that are beyond me, some people in various alternative agriculture spaces believe that the second Trump administration will regulate “Big Ag” and empower the small producers, who operate in more local and sustainable ways.

Truly, I cannot even begin to make a case of why this would happen. Trump himself has never thought about agriculture for more than thirty seconds. The guy splits his time between a golden Manhattan penthouse and a Florida beach resort. What Trump cares about is power and money, and “Big Ag” certainly has both of those.

Even if Trump genuinely believed in this cause, he’d still have to get through Congress. I will let the reader think about how the Senators and Congresspeople from Iowa and Illinois and Kansas and California and Missouri and North Carolina and Nebraska and Texas (to just name a few) would vote on that bill.

Inflation remains >2.5% (70%)

There seems to be growing recognition that the low inflation of the 2010s was the aberration, not a new normal. Historically, no decade since the 1920s, except for the 2010s, has averaged below 2.5% inflation. Low ~3-4% inflation is the norm. And since the inflation wave of 2021-2023, that is where we have stabilized at. Despite the Federal Reserve’s target of 2% inflation, I don’t think that will be achieved.

The uncertainty here is that I’m also predicting a recession, which should tank inflation. So in some way, I’m arguing contradictory positions. What can I say? I contain multitudes.

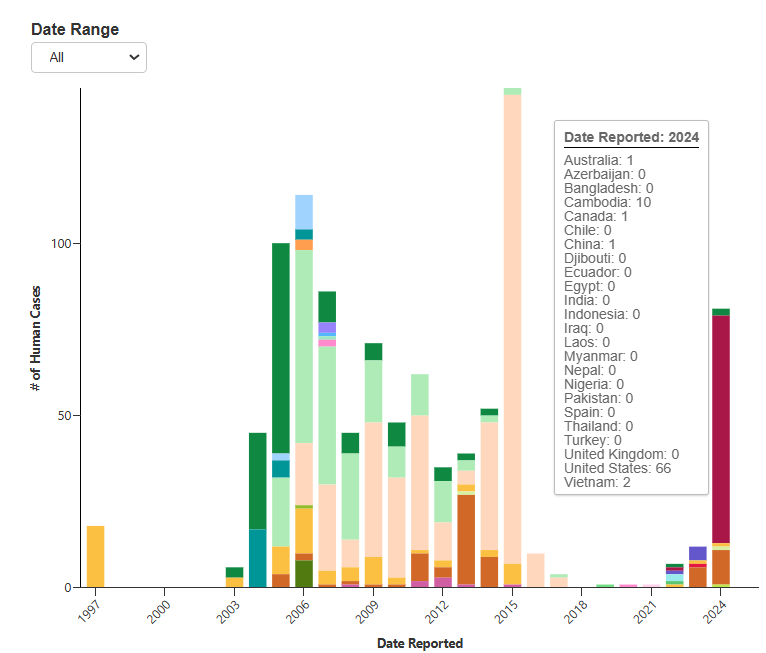

There is a H5N1 pandemic with sustained human-to-human transmission (30%)

H5N1 is a subtype of the influenza virus that has been circulating in birds since the mid-1990s. While there have been been semi-regular outbreaks in humans since then (below), these numbers mask the seriousness of the present situation.

We have never been closer to an H5N1 pandemic than we are right now. This is not hyperbole. As a former influenza researcher, I cannot emphasize how serious the present situation is.

Take that outbreak in Egypt in 2015. Yes, it is larger than the current outbreak by number of confirmed cases, but 99% of patients in that outbreak had direct poultry exposure and 35% had exposure to dead poultry. Only one (1) patient reported wearing protective equipment while handling these birds. Agricultural workers in Egypt directly breathing poultry litter and handling dead bird without PPE is a vastly different situation than the current one.

Today, H5N1 is not only spreading through both wild and agricultural birds, but more importantly, dozens of mammalian species in a variety of contexts: agricultural mammals, zoo mammals, pet mammals, and wild mammals. Furthermore, the human cases are in North America, some of which have reported no animal exposure at all.

Now, influenza has long plagued humanity. Seasonal influenza is essentially always a top ten cause of death per year, while the history suggests a pandemic influenza every ~20-25 years, or ~4% per year in any given year. But with the widespread outbreaks across both avian and mammalian species, and a growing number of human cases, the ‘surface area’ of attack that would allow the virus to adapt and evolve toward sustained human-to-human transmission has never been greater. We are on the precipice.

Now, this isn’t to say that a H5N1 pandemic is more likely than not. The jump from zoonotic influenza to sustained human-to-human transmission requires several low probability events. Moreover, during these steps, until a virus is endemic within a species, the possibility of transmission chains breaking and creating a “burnout” remains a possibility. There is a reason that influenza pandemics happen infrequently.

Taken together, I’m conservatively estimating a doubling of the odds a pandemic influenza in any given year, from ~4% to ~8%. Extrapolating that across four years suggests a ~30% probability of H5N1 going pandemic before January 2029.

The penny is eliminated (20%)

As mentioned above, the administration wants to decrease the budget deficit. They can do this in three ways: raise taxes and/or cut spending and/or increase efficiency. They clearly don’t want to raise taxes, leaving only spending cuts and increasing efficiency.

You can see this in that the “Department” of Government Efficiency (it is not a real department) which has been pushing for mainly various spending cuts.

A simple cut that has been proposed for many years is eliminating the penny. Pennies use ~3 cents of metal to create the ~1 cent coin. It has been estimated that we could directly save ~$200,000,000 per year by eliminating the penny (plus some indirect savings by no longer having to physically handle and transport them).

Now, this isn’t going to fix the federal deficit, but it’s an easy win with high public visibility that would save money in perpetuity. My understanding is that it would require Congress, so that makes it more complex than just an executive order, but Republicans do control both houses.

Long shot: these same arguments also apply to the nickel. Bonus bet: I’ll say 5% that both the penny and the nickel are eliminated.

Donald Trump dies before Inauguration 2029 (45%)

At 78, Donald Trump is the oldest incoming president in history. If you watch clips from 2016 (example clip), it is quite clear that he is no “spring chicken” either; he has declined an extraordinary amount, both physically and mentally.

According to Social Security’s actuarial tables, a 78-year-old male has a 5.3229% of dying that year, rising to 7.0947% in his 81st year. Statistics was never my best subject, but I believe that calculates out to the average 78-year-old male having a ~22.6% of dying before his 82nd birthday.

But Donald Trump isn’t the average 78-year-old.

Historically, the presidency is a fairly dangerous job, and Trump has already had multiple publicly-known assassination attempts on his life. On the other hand, presidents receive the best possible healthcare, see the response to Trump’s COVID infection during his first administration.

Trump is also quite tall and very probably obese, both raising the probability of death, yet he has also never drank or smoked, decreasing the probability of death. We also don’t have a trustworthy medical evaluation of his health, preventing us from calibrating on that, but we do know he golfs regularly, which is at least some exercise.

Taken all together, I’m going to increase the ~22.6% likelihood of death for the average 78-year-old over four years to a 45% chance of death for Donald Trump.

The Tiktok forced divesture law is enforced (95%)

Congress passed a bipartisan bill to force the divesture of Tiktok from the Chinese company ByteDance. That bill was signed into law by President Biden. The law was challenge and the Supreme Court unanimously upheld the law.

I don’t think we’ve come to terms with how close we are to a Constitutional crisis. Donald Trump is not a king. Congress and the President passed a law and it was unanimously upheld by the Supreme Court.

Now, part of that law was that the President can issue a 90-day extension to help a divestiture be negotiated. But if 90 days from now, ByteDance continues to own the American operates of Tiktok, the app should be removed from all American phones.

Generally, I am confident that saner heads will prevail after the gravity of the situation is realized. Moreover, the law places liability onto the companies, and even if Trump is successful in the short term, I really don’t think that Apple and Google want to risk a lawsuit.

Emergency 18th Prediction: The grift will be unimaginable and shameless (100.0%)

With the launch of the $TRUMP and $MELANIA coins, this isn’t even a prediction.

I don’t really know what to say anymore. Trump has always been a shameless, corrupt, scam artist. He bankrupted casinos, businesses mathematically designed to make money. He has been convicted of multiple crimes, ranging from fraud to sexual assault. He won’t disclose his tax returns or divest from his businesses.

But launching cryptocurrency memecoins the weekend before the Inauguration is galling, even for him.

He is an amoral, know-nothing, corrupt, authoritarian kleptocrat. He just is and you are delusional to deny it. Let us hope and pray that our institutions survive him and the Republican party that swears fealty to him.