AI Bubble or Island Of Stability?

How the periodic table explains the current economy.

The Counterpoint is a newsletter that uses both analytic and holistic thinking to examine the wider world. My goal is that you find it ‘worth reading’ rather than it necessarily ‘being right.’ Expect semi-regular essays on a variety of topics. I appreciate any and all sharing or subscriptions, as it helps support both my family and farm.

In February, I stated that I’d turned mildly to moderately bearish on the economy.

Today, the S&P500 is up ~13% YTD and near all-time highs, gold has doubled in price over the last two years, house prices continue to rise nationally, and everything from US treasuries to Bitcoin has positive returns over the year. Unemployment remains low at ~4.3% and in the latest round of earnings reports from US banks suggest that “the consumer is resilient, spending is strong, and delinquency rates are actually coming in below expectations.”

While I will highlight the “this is not a prediction of an immediate crash or the impossibility of continued economic strength” from my statement, such a divergence between prediction and reality requires real reflection.

And perhaps the answer to the current economy lies in the periodic table.

Prepare for a brief trip down memory lane to high school chemistry.

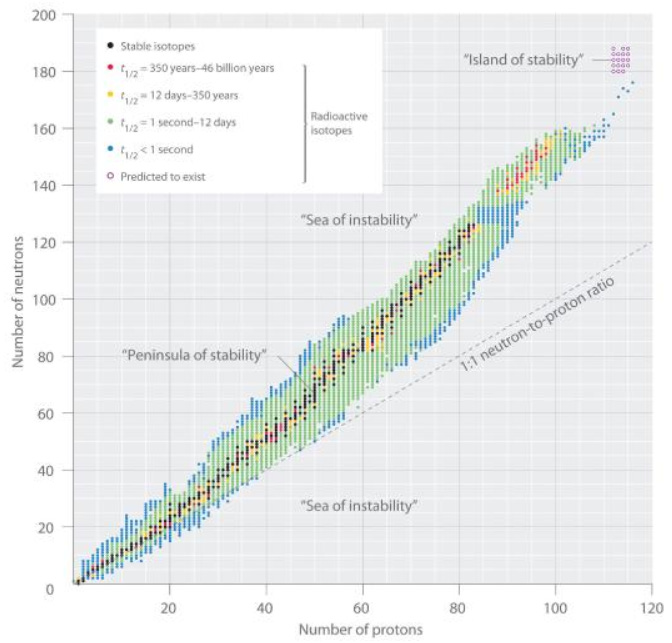

Every element is defined by its number of protons, e.g. hydrogen has one proton, helium has two, carbon has six, etc. The isotopes of each element are determined by their varying number of neutrons., e.g. carbon-12, carbon-13, and carbon-14 each have six protons but then six, seven, and eight neutrons, respectively. The interactions of each isotope’s protons and neutrons determines its stability. Carbon-12 is stable indefinitely, while carbon-14 has a half-life of ~5,730 years.

Now, if you plot all the elements and their isotopes by their number of protons and their number of neutrons, and then color those points by their half-life, you’ll get this:

You’ll probably quickly notice two things. First, heavier elements move away from a 1:1 ratio of protons to neutrons. Second, past lead (82 protons) all elements and their isotopes are unstable.

But while many of the heaviest elements and their isotopes have incredibly short half-lives, with many breaking down within milliseconds (blue) and at most days (green), notice that there is an “island” of pink from 89 protons to 103 protons. These are the actinides, a series of fifteen metallic elements in the periodic table that are technically unstable, but have half-lives that range from centuries to billions of years. This pseudo-stability makes them useful, with the most widely-known actinides being uranium and plutonium.

Past the actinides, every element and isotope discovered has been extremely unstable. But because there is a gap of instability between lead and the actinides, some scientists have postulated that there will be another “island of stability” (top right hand corner of the chart, purple circles), a group of isotopes whose protons and neutrons interact in just the right way to produce stability.

And I think that this is exactly what is happening right now with the economy and society; we’re in a sea of instability trying to navigate toward and land on an island of stability. The entire economy hinges on whether or not AI, and our response to its development, will lead us there.

“The economy” can never be reduced to just one thing. It is the confluence of the interactions of thousands of different micro- and macro- trends that shift over time. And today’s economy isn’t your grandfather’s economy. For example:

Companies are simply better: No matter the domain, whether it is marathon times or airline safety, F1 pit stop times or cancer survival rates, humanity’s relentless pursuit has resulted in steady improvements. Yet rarely is that logic applied to businesses. Just as athletes have improved over time, so have CEOs and operational teams. Today’s businesses are simply better than in previous eras. Whether it’s operating margins or net income, the “MAG7” stocks of today are better

More investor involvement: more American households own stocks than ever before. Part of that is the rise of individualized retirement accounts like 401ks and Roth IRAs, but also direct investment platforms like Interactive Brokers and Robinhood. Moreover, not only is it easier, but it is also cheaper to invest than ever before. Trading fees have been reduced to zero, competition has pushed expense ratios of ETFs toward zero, etc.

Fiscal dominance: After a 40-year bond bull market, one of the major trends is the shift from monetary to fiscal dominance, where the financing of governmental debt supersedes monetary policy, overriding the central bank’s mandate to control inflation. Many astute thinkers, such as Ben Kizemchuk and PauloMacro have elaborated on this ongoing shift (recommended long-form interviews with them here and here, respectively).

Gambling mentality: whether its Silicon Valley-style entrepreneurship or old fashioned sports gambling, zero-day-to-expiration options or predictions, people are more willing to risk money on speculation for outsized returns than ever before.

Demographics: the Boomers are both the largest and the richest generation to ever reach retirement, and with modern biomedical technology, they will likely live longer than any previous generation. Meanwhile, fertility rates are collapsing across the global, leading to never-before-seen demographic pyramids.

Now, with all that being said, there is really only one thing that matters right now for the economy. You might have heard of this little thing called “artificial intelligence.”1

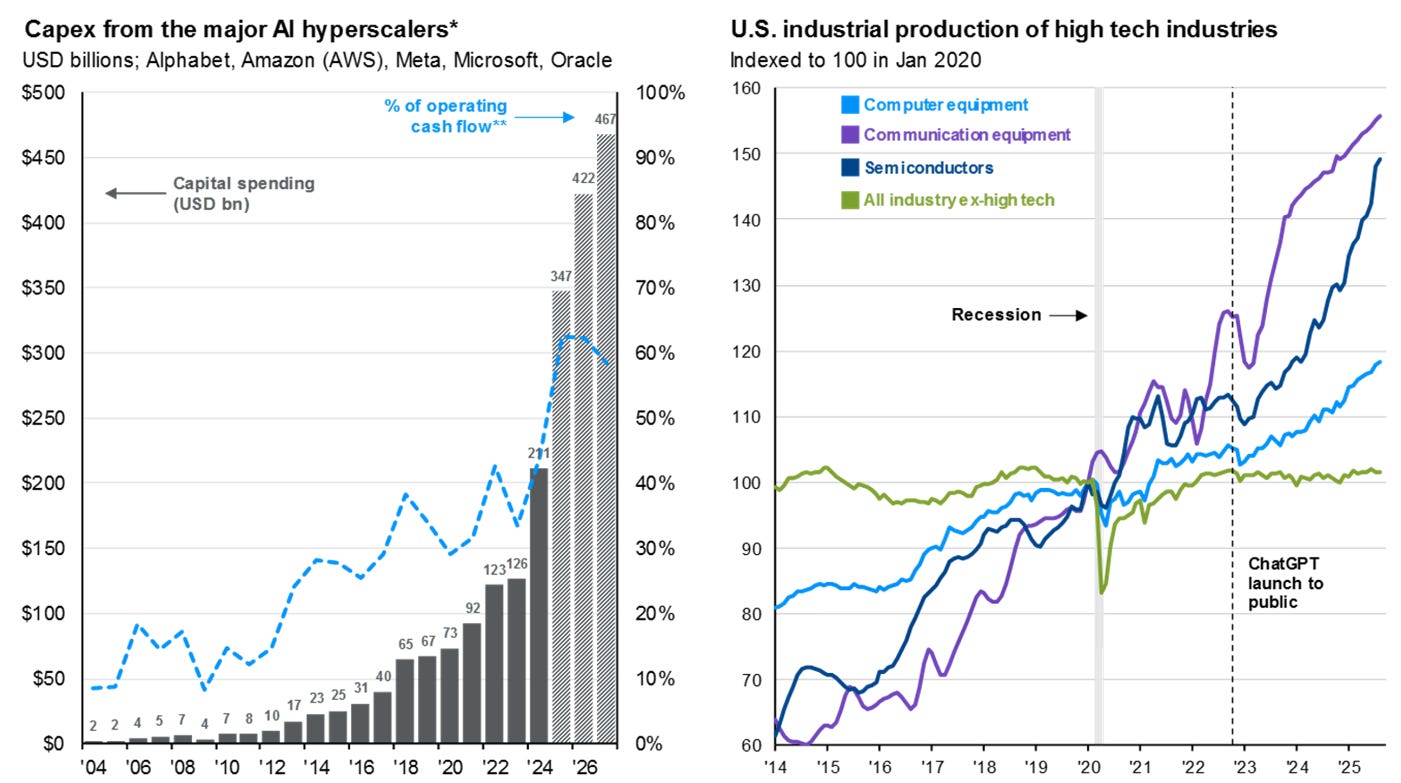

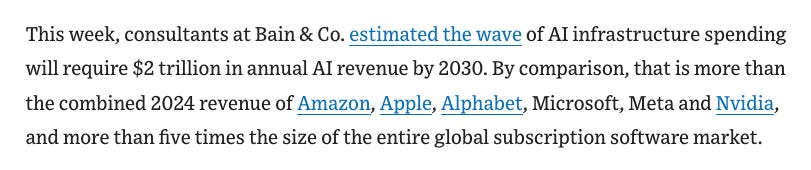

And it doesn’t really matter if you believe in it or not, because the fact of the matter is that it is happening. The world is currently experiencing perhaps the largest investment cycle in history as companies chase what, if successful, will probably be the most economic lucrative technology in history.

Make no mistake, if AGI is successful, it will fundamentally change society more than other technology since agriculture has.

While it is easy to sell doom (and perhaps even prudent to do so as to prepare), we should acknowledge that “the Fourth Industrial Revolution” really could provide us with unfathomable levels of wealth and prosperity, just as previous industrial revolutions have provided us with relative to ancient societies. “Fully Automated Luxury Communism” (or whatever you’d like to call it) is a possibility that we need to take seriously.

Yet with return comes risk, and by definition, any disruptive technology has downsides. In order to reach any “island of stability,” we have to navigate through that “sea of instability.” And ifthe upsides of these technologies are higher, so are the downsides. In “If AGI Is Coming, We Need a New Otto Von Bismarck,” I wrote about how it will fundamentally alter the current societal and geopolitical contracts. In “We Have Become Death, Destroyer Of Fences,” I wrote about how it will tear down some of humanity’s most basic “Chesterton Fences.”

Is humanity ready? Can we traverse the waters of instability and reach an “island of stability.” I don’t know. But in the short term, literally trillions of dollars rests on that outcome.

One of my criticisms in “The Many Foundational Issues of Lab-grown Meat” was that depreciation was a real expense. So let me repeat, depreciation is a real expense.

If you buy a shovel for $20, start charging a $1 to dig a hole, but it breaks after nineteen holes, that is a bad investment. And a series of bad investments is how we get a recession, and even a depression.

Whether it is building out data centers the size of cities or buying the rapidly-rising-in-price electricity to fuel them, trillions of dollars is being invested into the “AI economy.” And while buying the chips necessary is a topic du jour, fueling gains in Nvidia, AMD, Broadcom, and others, I think that the full life-cycle of these chips remains vastly underappreciated. The vicious and cutthroat competition required to maintain an “edge” in AI, means that these chips will rapidly become obsolescent, and in order to be a good investment, will have to earn more revenue, more quickly, than any technology or product in human history.

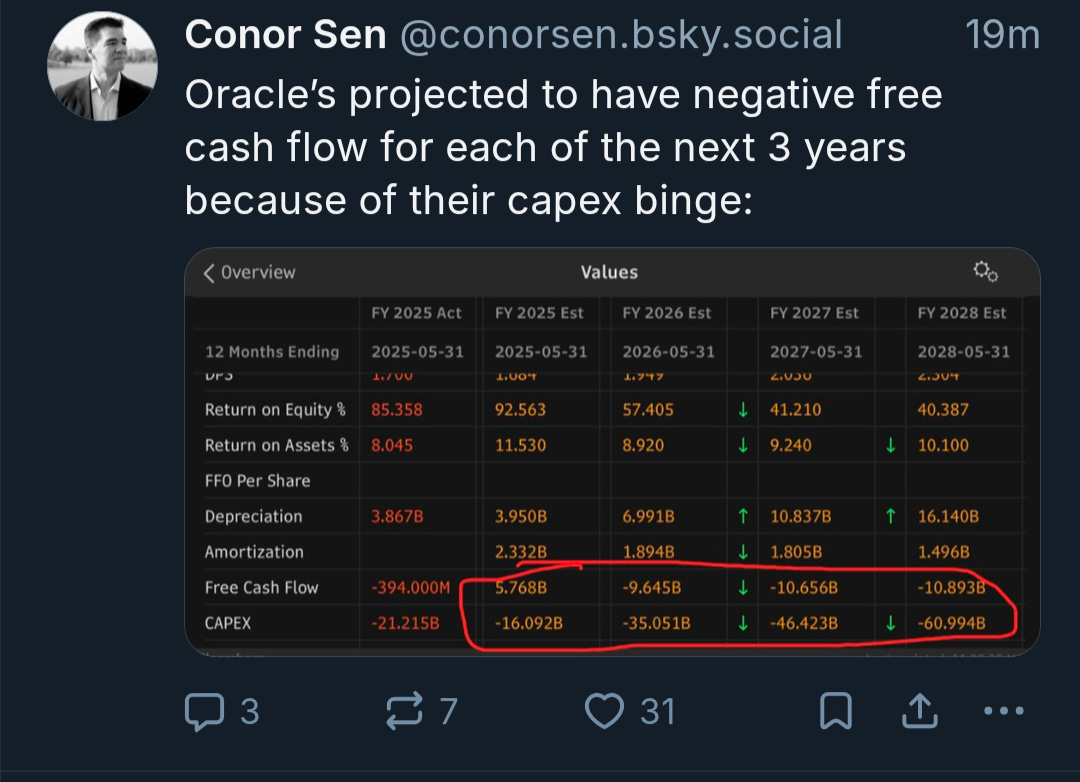

And the financial markets are aware of these realities. Forward-looking earnings and free cash flows are reduced, even into the negative, across various companies.

But as of now, everyone is acting like these investments will pay off. All of this money being thrown around is acting as proverbial rocket fuel propellant and that it is a certainty that the AGI economy will hit escape velocity, that we will hit that island of stability, not only in economic terms, but socially and geopolitically as well.

And maybe we will. But the sea of instability is a lot larger than the island of stability.

Robotics, biotech, autonomous cars, next-generation energy technologies, and other physical systems should also be included in this, but for brevity purposes, I’ll continue to shorthand it as “AI.”

Excellent analysis! That periodic table analogy is so clever, realy makes you think.